Understanding Range Bar Charts and Their Role in Forex Trading

Aug 26, 2024 By Elva Flynn

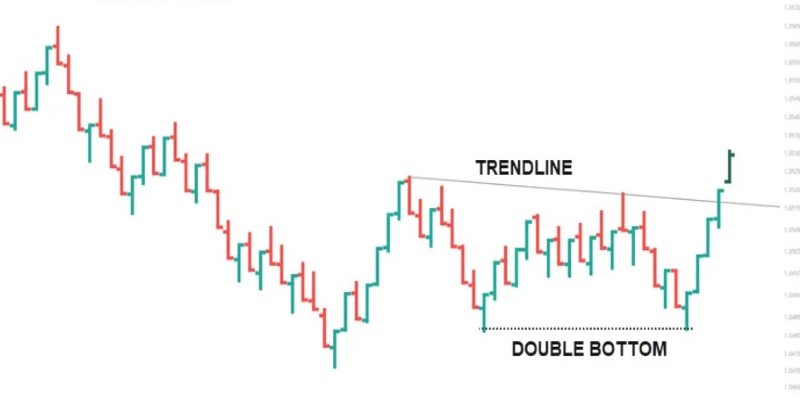

Successful decision-making in Forex trading often depends on accurately interpreting market data. Traditional charts, such as candlestick and line charts, are widely used, but they have limitations, especially during periods of high volatility or low liquidity. Range bar charts offer a different approach by focusing exclusively on price movement, allowing traders to eliminate the distractions of time and create clearer insights into trends.

This article will dive into the practical application of range bar charts in Forex trading, exploring their mechanics, benefits, and ways to incorporate them into trading strategies for more precise analysis.

What Are Range Bar Charts?

Unlike time-based charts that plot a new bar after a fixed interval (like every minute, hour, or day), range bar charts only form a new bar once a specific price range is reached. Each bar represents a fixed amount of price movement, and time is irrelevant.

For instance, in a range bar chart with a 10-pip range, a new bar will only be created after the market moves 10 pips, regardless of how long that movement takes. This unique approach makes range bar charts especially useful in filtering out noise and focusing purely on price action, giving traders a clear view of the markets movement.

How Range Bar Charts Work in Forex Trading?

In Forex trading, currency price fluctuations can be rapid and erratic. Traditional charts, like candlesticks, are bound by time intervals, which can sometimes obscure key price movements or exaggerate noise. Range bar charts eliminate this issue by concentrating only on price. Traders set the range, say 5, 10, or 20 pips and the chart develops a new bar only when the currency pair has moved that set range.

For example, if you set a 15-pip range, a new bar will only appear once the currency price moves either 15-pip up or down. This allows for consistent analysis regardless of how fast or slow the market is moving. As a result, during high volatility, you may see several bars forming quickly, while during periods of low activity, bars may take longer to develop. The simplicity of the chart makes it easier for traders to spot trends and manage trades, making it a valuable tool for both beginners and experienced Forex traders.

Advantages and Disadvantages of Using Range Bar Charts in Forex Trading

Range bar charts are a unique tool in forex trading, focusing solely on price movements rather than time intervals. Unlike traditional candlestick charts, range bars create a new bar only when the price moves by a specified amount, regardless of how much time passes. This method offers both advantages and some limitations for traders looking to enhance their strategies.

Advantages of Using Range Bar Charts in Forex Trading

Focuses on Price Movement: The primary advantage of range bar charts is that they focus solely on price movement, disregarding time intervals. This eliminates the clutter seen in traditional time-based charts, allowing traders to concentrate on genuine market trends rather than short-term noise.

Reduces Market Noise: Range bar charts filter out minor price fluctuations that might appear as noise in other chart types, especially during periods of low volatility. This cleaner view helps traders identify significant price movements and make more informed decisions.

Adaptable to Market Volatility: Range bar charts are particularly useful in volatile markets. Since each bar is formed based on a fixed price range, more bars appear during high volatility, highlighting the intensity of market movement. This real-time adaptability provides better insight compared to time-based charts that might show inconsistent data during rapid price swings.

Disadvantages of Using Range Bar Charts in Forex Trading

Difficulty in Selecting the Right Range: Choosing the appropriate range size is critical in range bar charts, but it can be challenging. A range set too small may produce too many bars, leading to overtrading and analysis paralysis. Conversely, a range thats too large might result in fewer bars, hiding short-term opportunities or important market signals.

Requires Experience and Customization: Effectively using range bar charts requires a good understanding of how they work and how to adjust settings for different market conditions. Without sufficient backtesting and practice, beginners might struggle to find the optimal range size or misinterpret signals.

Not Suitable for All Market Conditions: Range bar charts can be less effective in extremely low-volatility environments. During periods of minimal price movement, range bars may take a long time to form, leading to delayed signals. In such cases, traditional time-based charts might provide better insight into market sentiment.

Customizing Range Bar Charts for Different Market Conditions

Different market conditions may call for adjustments in range bar settings. During periods of high volatility, such as major economic announcements or geopolitical events, tightening the range can give more detailed insights. In contrast, during calm market conditions, widening the range can help reduce the formation of unnecessary bars and focus only on significant price movements.

Range bar charts are also flexible enough to be used across various timeframes, depending on your trading style. Day traders might prefer tight ranges to capture intraday moves, while swing traders could opt for wider ranges to filter out smaller fluctuations and focus on broader trends.

Conclusion

Range bar charts are useful in Forex trading for highlighting price movements by removing less significant price changes, known as "market noise." These charts excel during volatile market conditions and are effective for scalping, as they show clearer trends and breakout points.

Traders must select an appropriate range size, which can vary with market conditions, demanding some expertise. While these charts do not display volume data and are less commonly used than other types, they still provide a precise tool for traders focused on detailed price analysis, helping to enhance decision-making in trading strategies.

Harnessing the Power of the Paceline Card: 8 Key Insights

Green Dot Credit Cards Demystified: 8 Key Points You Should Be Aware Of

Navigating Your Finances: OneMain Financial Personal Loan Deep Dive

Do Corporations Pay State and Federal Taxes?

Understanding Range Bar Charts and Their Role in Forex Trading

Umar Ashraf: Founder of TradeZella and His Vision for the Future

When Work Feels Like a Drag: How to Have That Talk with Your Boss

Why Do Wealthier Students Receive More Help Than Others

Uncovering a Key Tax Acronym: What You Need to Know